Jumpstarting growth in 2021!

107% increase in profit for the year

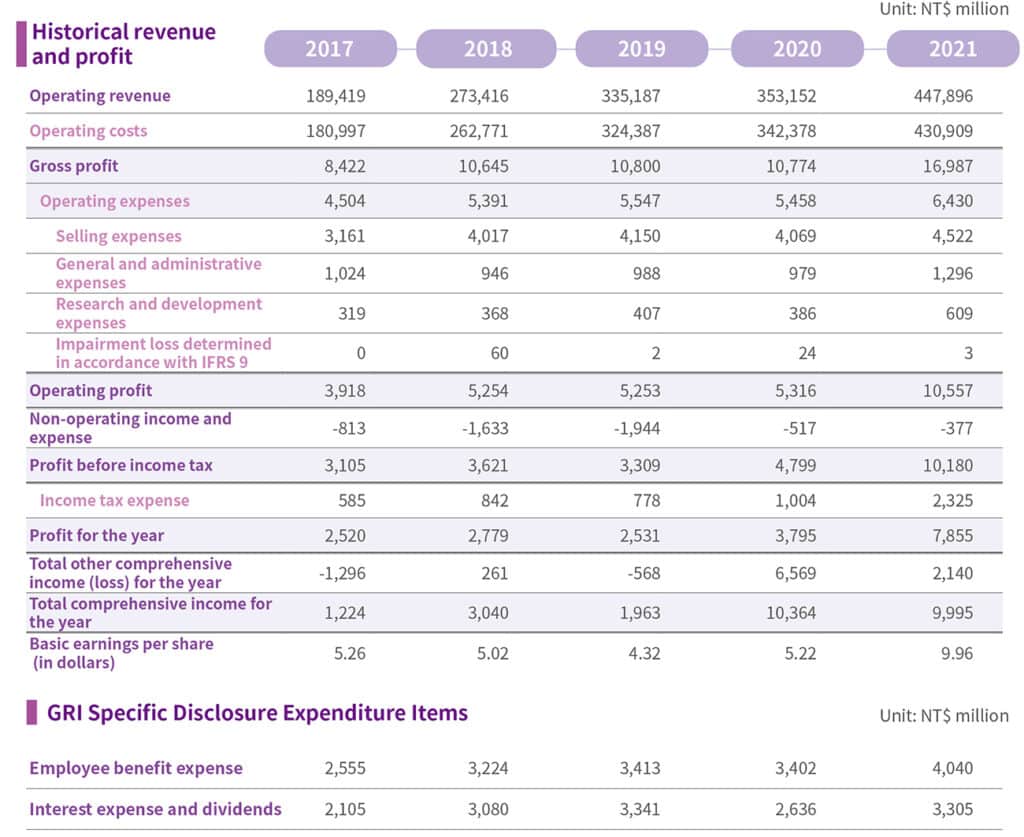

Our operating revenue increased by 27% from NT$353.152 billion in 2020 to NT$447.896 billion in 2021. Our profit for the year increased by 107% from NT$3.795 billion in 2020 to NT$7.855 billion in 2021, increase of NT$4.06 billion.

Post-Pandemic Era Approaches, Positive Outlooks for Semiconductors

With the accelerated global digitization driven by the pandemic and the increased demand for energy saving and carbon reduction due to climate change, the main drive for growth in 2021 comes from as increased semiconductor content in electronic products and the rapid growth in applications such as automotive electronics, industrial control, data centers, and 5G communications. In the future, in addition to developing high-growth product markets and increasing customer penetration, we will continue to carry out digital optimization to continuously improve operational efficiency, optimize our operations management system, enhance our financial control system, and strengthen our human resources management to deepen our ability to provide added value in the semiconductor industry chain, thereby building a foundation for sustainable business operations.